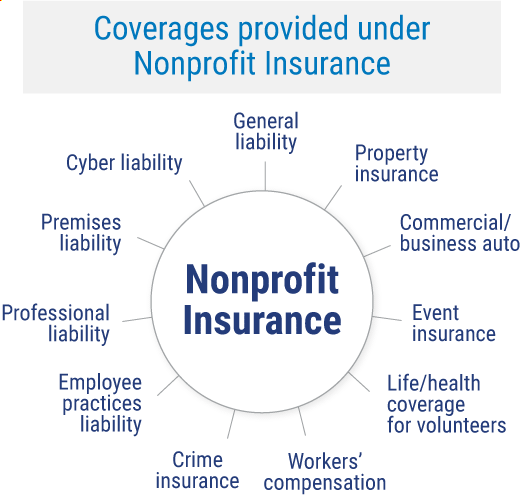

Protecting a Global Remote Workforce with Insurance

As remote working models are embraced by multinational companies, ensuring comprehensive coverage for a dispersed global workforce poses challenges. Tailoring group and voluntary insurance policies that align to myriad regulations across different countries is key for risk mitigation. Here are some important facts of Top Insurance for Remote Workers are listed below.

Key Insurance Needs of Remote Staffers

Whether employees operate from home or shared coworking spaces abroad, their core insurance needs remain similar:

• Health insurance protecting against medical costs globally

• Disability insurance replacing income if unable to work

• Life insurance and beneficiaries for families

• Cyber insurance shields for home/public internet usage

• Personal liability coverage against negligence claims

Additionally, remote staffers traveling routinely need international coverage for:

• Emergency medical evacuations

• Lost baggage and trip delays

• Accidental death and dismemberment

• Political risk and terrorism events

For employers, major risks also stem from data breaches, reputation damage, and ensuring duty of care across borders.

Challenges of Fragmented Policies

Conventionally, multinationals stitch together insurance from various national providers and group plans locally. But this fragments coverage gaps arise for remote employees mobile across countries.

Drawbacks include:

• Inconsistent coverage and claim experiences

• Compliance failures under location-specific laws

• Administration complexities for employers

• Limited risk insights from disparate vendors

Such issues expose remote workforces to uncertainties which specialized global insurance can mitigate.

Holistic International Insurance Partners

Savvy multinationals now partner with integrated carriers offering consistent voluntary benefits bundles aligned to remote staffers and compliance needs worldwide. This promises:

• Portable coverage across 180+ countries

• Globally integrated claims handling

• Dedicated account management

• Automated tracking of insurance eligibility

• Local assistance within each geography

• Value-added risk management insights

Such carriers enable frictionless coverage for a globally dispersed remote workforce while easing HR obligations for employers. As remote work proliferates, unlocking insurance efficiencies is key for managing risks of distributed teams. Partnering the right expert is vital.